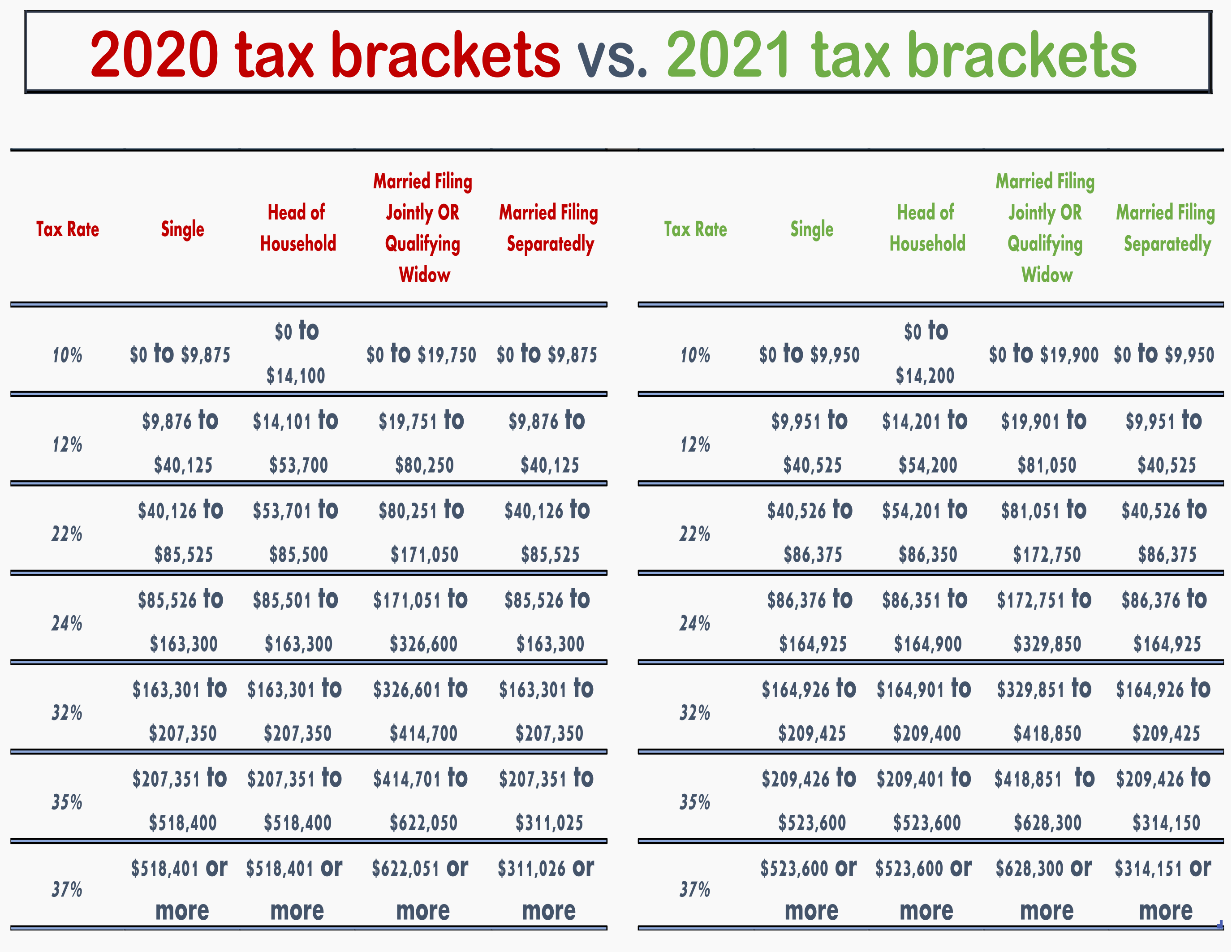

The difference between bracket ranges sometimes creates a " marriage penalty." This tax-law twist makes certain married couples filing a joint return pay more tax than they would if they were single (typically, where the spouses' incomes are similar). That's a lot of money, but it's still $35,928 less than if the 37% rate were applied as a flat rate on the entire $1 million (which would result in a $370,000 tax bill). So, for example, the tax on $1 million for a single person in 2021 is $334,072. The rest will be taxed at lower rates as described above. If you're single, only your 2021 income over $523,600 is going to be taxed at the top rate (37%). Now, suppose you're a millionaire (we can all dream, right?). (That's $5,979 less than if a flat 24% rate was applied to the entire $90,000.) When you add it all up, your total 2021 tax is only $15,621. That leaves only $3,625 of your taxable income (the amount over $86,375) to be taxed at the 24% rate, which comes to an addition $870 of tax. After that, the next $45,850 of your income (from $40,526 to $86,375) is taxed at the 22% rate for $10,087 of tax. The next $30,575 of income (the amount from $9,951 to $40,525) is taxed at the 12% rate for an additional $3,669 of tax. Again, assuming you're single with $90,000 taxable income in 2021, the first $9,950 of your income is taxed at the 10% rate for $995 of tax. SEE MORE Child Tax Credit Payment Schedule for the Rest of 2021 So, now that you're focused on your 2021 taxes, here are the tax brackets you'll use when you file your tax return next year: 2021 Tax Brackets for Single Filers and Married Couples Filing Jointly (For 2020, the 22% tax bracket for singles went from $40,126 to $85,525, while the same rate applied to head-of-household filers with taxable income from $53,701 to $85,500.)

For example, the 22% tax bracket for the 2021 tax year goes from $40,526 to $86,375 for single taxpayers, but it starts at $54,201 and ends at $86,350 for head-of-household filers. The 20 tax bracket ranges also differ depending on your filing status. SEE MORE Tax Changes and Key Amounts for the 2021 Tax Year That means you could wind up in a different tax bracket when you file your 2021 return than the bracket you were in for 2020 – which also means you could be subject to a different tax rate on some of your 2021 income, too. However, as they are every year, the 2021 tax brackets were adjusted to account for inflation. When it comes to federal income tax rates and brackets, the tax rates themselves didn't change from 2020 to 2021. Effective tax planning also requires an understanding of what's new or changed from the previous tax year. For most Americans, that's their return for the 2021 tax year - which will be due on Ap(April 19 for residents of Maine and Massachusetts). Smart taxpayers are planning ahead and already thinking about their next federal income tax return.

Picture of numbers on blocks showing the year 2020 being changed to 2021 Getty Images

0 kommentar(er)

0 kommentar(er)